Medicare Costs

Understanding Medicare Cost for 2025

Navigating Medicare costs in 2025 can feel overwhelming, but our comprehensive guide makes it easy to understand what you can expect. Whether you’re new to Medicare or looking to update your plan, we’ve got you covered.

What Are the Medicare Costs for 2025

Medicare costs can vary based on the specific parts of Medicare you enroll in: Part A, Part B, Part C, and Part D. Here’s a breakdown of each:

Medicare Part A (Hospital Insurance)

Premiums:

Most people don’t pay a monthly premium for Part A if they or their spouse paid Medicare taxes while working a minimum of 40 quarters. If required to pay a premium, the standard premium for 2025 can range from $285 to $515 per month.

Deductibles:

The Part A Hospital deductible is $1,676 per benefit period.

Coinsurance:

After the deductible, you pay $0 for the first 60 days of inpatient hospital care. From day 61-90, it’s $419 per day, and after 90 days, it’s $838 per “lifetime reserve day”. For skilled nursing services, day 1-20 is generally a $0.00; however, at day 21-100, the copayment is $209.50 per day. For day 101 and beyond, you are responsible for all costs. Hospice care is generally $0; however, a copayment of up to $5 may apply for each prescription drug. For inpatient respite care related to hospice care, 5% of the Medicare approved amount is your coinsurance amount.

Medicare Part B (Medical Insurance)

Premiums:

The standard monthly premium for Part B in 2025 is $185.00, but it can be higher based on your income. The surcharge you may pay for Medicare Part-B is referred to as the Income Related Monthly Adjustment Amount.

At the time you receive services from a medical provider or facility, the costs are as follows:

Deductibles:

The annual deductible for Part B is $257.

Coinsurance:

After meeting the deductible, you typically pay 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment. Medicare-covered laboratory tests are $0 copayment.

Medicare Part C (Medicare Advantage)

Premiums and Costs:

These vary widely depending on the plan and provider. Medicare Advantage plans often offer additional benefits beyond Original Medicare, which can impact overall costs. Keep in mind, you must continue to pay your Medicare Part B premium even if you choose to enroll in a Part C plan. Please read “Medicare Part C” under the “Additional Coverage” tab for more information.

Medicare Part D (Perscription Drug Coverage)

Premiums and Other Out-of-Pocket Costs:

Part D premiums, deductibles, copayments, and coinsurance depend on the plan you choose and can vary significantly. Please read “Medicare Part D” under the “Additional Coverage” tab for more information.

Medicare Supplement (Medigap)

Premiums and Other Out-of-Pocket Costs:

Medicare Supplement premiums, deductibles, copayments, and coinsurance depend on the plan you choose and can vary significantly. Please read “Medicare Supplement” under the “Additional Coverage” tab for more information.

Factors Affecting Your Medicare Costs

Your specific Medicare costs can be influenced by several factors:

Late Enrollment Penalties (LEP):

A Late Enrollment Penalty, can be charged on Part B and Part D.

Part B's Late Enrollment Penalty

If you don’t sign up for Medicare Part B when you are initially eligible and don’t have other creditable medical coverage (like an employer plan), you may be charged a Late Enrollment Penalty (LEP). You will pay an extra 10% for each full year you could have signed up for Part B, but didn’t. This is a lifetime penalty unless you qualify for financial assistance from the State.

Part D's Late Enrollment Penalty

If at any time after you qualify for Medicare Part A or B and your Initial Enrollment Period is over, there is a period of 63 consecutive days or more that you don’t have creditable prescription drug coverage, you may be assessed a Late Enrollment Penalty. This penalty will be assessed by Medicare and will be charged to you each month you have Medicare drug coverage. Currently, Medicare calculates it by multiplying 1% of the national base beneficiary premium ($36.78 in 2025) times the number of full, uncovered months you did not have creditable drug coverage. This is a lifetime penalty unless you qualify for financial assistance from the State.

Income:

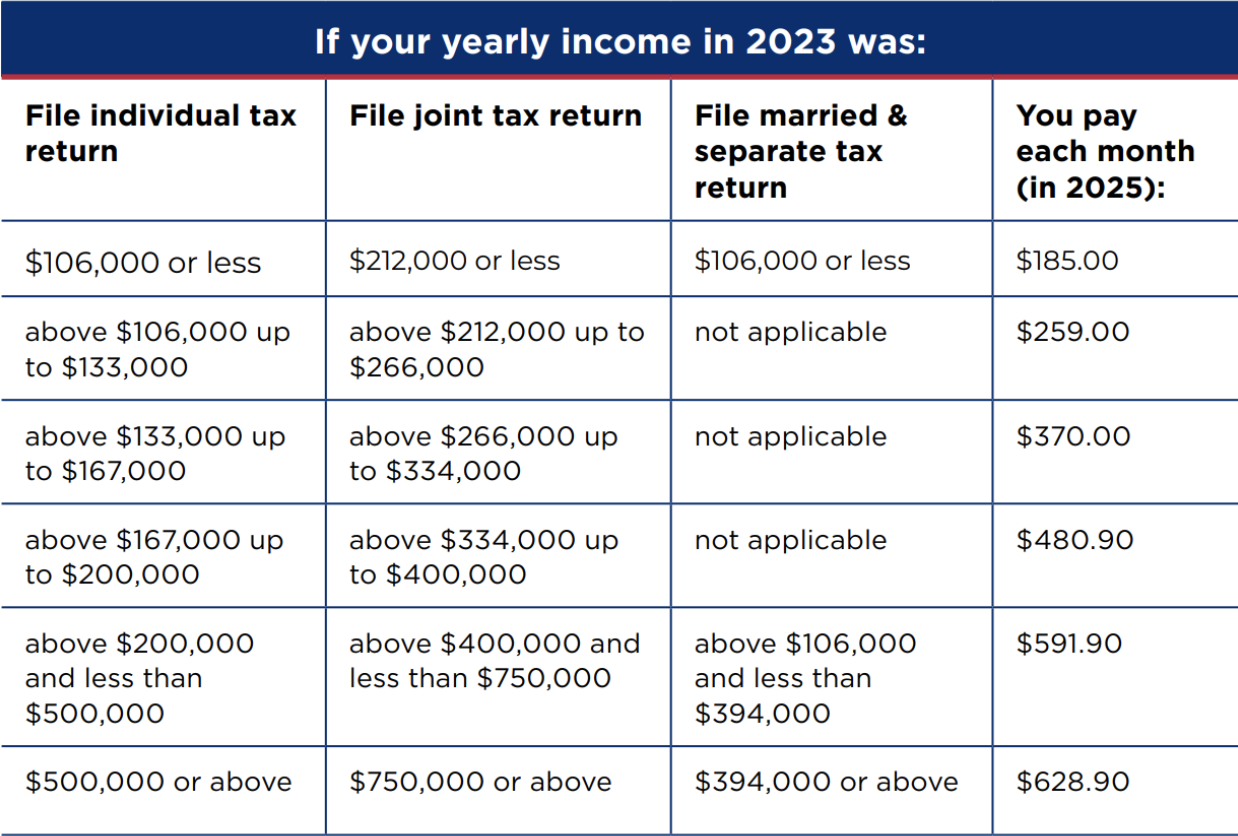

Higher income can lead to higher premiums for Part B and Part D. This additional surcharge, referred to as the Income Related Monthly Adjustment Amount (IRMAA), is calculated by Medicare. It is based on your reported income from 2 years prior. After IRMAA is calculated, the adjusted monthly premium for Part B is as follows:

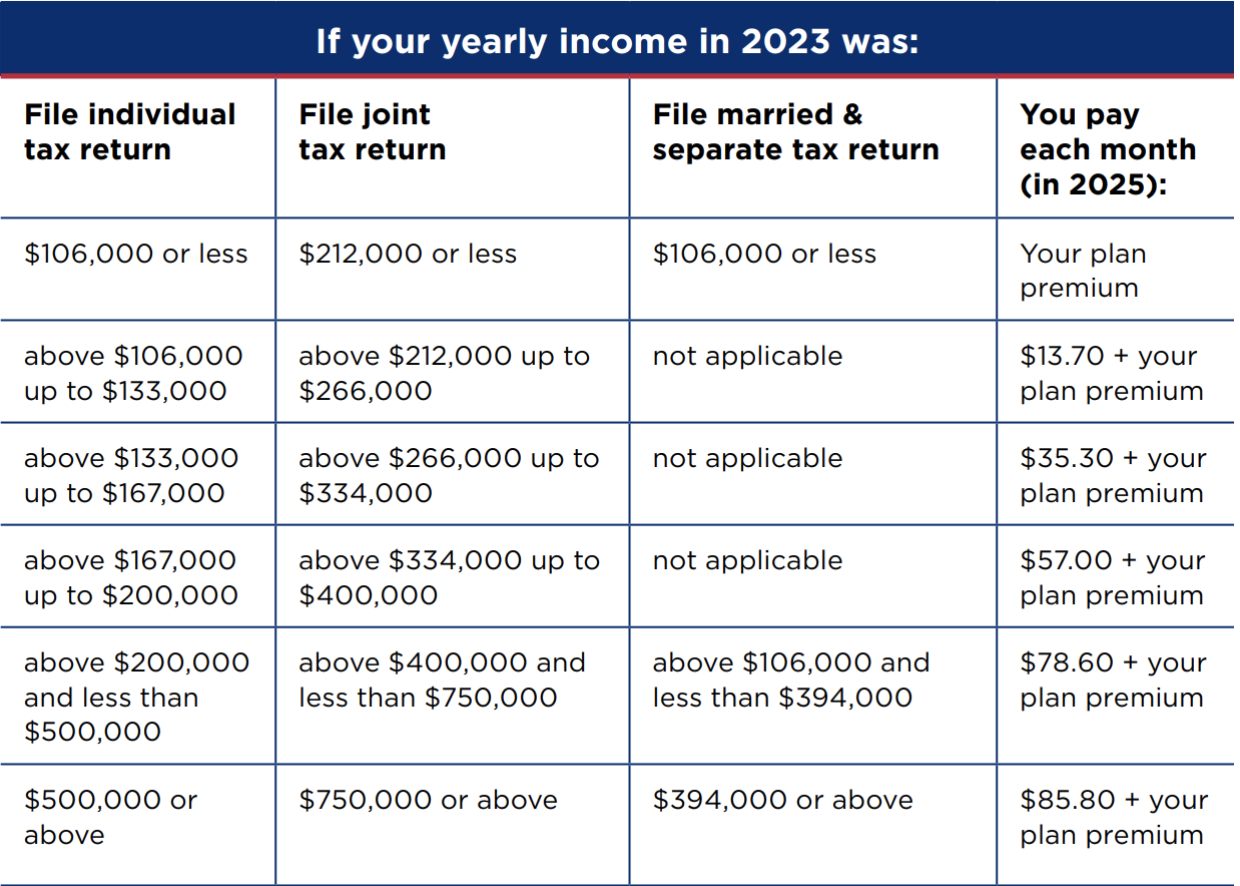

If you are assessed an IRMAA for Medicare Part B, you will be charged an additional premium for Medicare Part D, as well. The additional premium is indicated in the table below.

-

Review Your Plan Annually:

Medicare plans and costs change yearly. Make sure to review your plan during the Annual Enrollment Period (October 15 – December 7) to ensure it meets your needs.

-

Consider a Medicare Advantage Plan:

These plans often offer extra benefits and can sometimes be more cost-effective than Original Medicare.

-

Apply for Assistance Programs:

Programs like Medicaid, the Medicare Savings Program, and Extra Help can assist with premiums, deductibles, and drug costs for those who qualify.

How to Lower Your Medicare Costs

Get Expert Help

Understanding Medicare costs is crucial to managing your healthcare expenses effectively. Our insurance brokers are here to help you navigate your options and find the best plan tailored to your needs. Contact us today for a free consultation and personalized Medicare plan comparison.

By understanding the details of Medicare costs for 2025, you can make informed decisions that insure you get the most out of you healthcare coverage. Let us help you navigate the complexities of Medicare so that you can focus on what matters most - your health and well-being.

For More

If you prefer white glove service from At Your Service Insurance Brokerage, LLC, where we will complete a plan comparison on your behalf, click here!

For self help, plan options, and enrollment, please click here!